We are Financial Professionals

Unlocking

Potential

Together

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

About Me

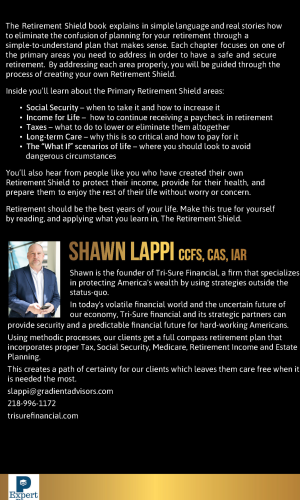

My name is Shawn Lappi.

I am the CEO of Tri-Sure Financial.

Tri-Sure Financial focuses on wealth creation and wealth protection.

Wealth creation in the form managing assets along with my strategic partners -Gradient

Investments – based out of Arden Hills Minnesota.

Gradient Investments manages over 67 billion dollars in assets and operates in all 50 states in

the USA.

Together we strategize according the clients risk tolerance, goals and objectives. This can be

short term, long term or a combinations of both. We use various market strategies to grow our

clients assets.

Recurring Seminar Topics

Seminars

Upcoming Seminars

28

Nov

Seminar Title here

- Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consecte

28

Nov

Seminar Title here

- Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consecte

28

Nov

Seminar Title here

- Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet, consecte

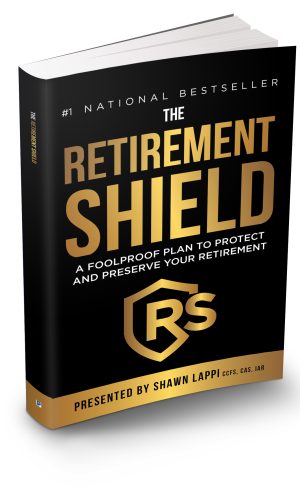

RETIREMENT SHIELD

Our Financial Services

Asset Allocation & Risk

We pride ourselves on providing retirement strategies to Little Rock, AR and the surrounding communities. We take a look at your unique mix of assets and integrate those aspects into a coordinated plan.

Income Planning

Income planning for retirement can be a daunting task because there’s a lot to learn. At Day Investment Advisors, LLC, we’re here to help you navigate throughout each of the three income planning phases

Legacy Planning

Enhanced planning is one key element of any retirement strategy and helps ensure that you leave a legacy of family harmony, regardless of the size of your estate.

Social Security

Your Social Security benefit represents years of savings and hard work, which is why we work to ensure you understand how it fits your retirement strategy.

Tax Strategies

One part of building your retirement is determining your tax liability and developing a strategy to help minimize how much you pay. We recommend customizing